As you prepare for your retirement, you may have already taken a smart step and visited with the Social Security office to understand what your benefit will look like in retirement. These meetings can often end in frustration if you find out that your Social Security benefit may be subject to the Windfall Elimination Provision (WEP). This provision can reduce your monthly Social Security benefit but the representative assisting you may not be able to tell you exactly how your benefit will be affected. This article is intended to shed some light on what WEP is and how you might be affected by it.

To Understand WEP, first you must understand some basics of Social Security

Social Security was designed by the US government following the Great Depression as a form of “Social Insurance,” providing retirement income to those over the age of 65. (Never-mind that the average life expectancy of Americans in 1935 was below the age of 65). Social Security is designed to replace some of your pre-retirement earnings. The formula to determine your Social Security benefit has been designed so that lower income earners receive a higher replacement rate of their pre-retirement earnings than higher income earners. There are several steps to understand this formula:

The first step is to determine your inflation adjusted average indexed monthly earnings (AIME). The Social Security website provides a calculator here. Your AIME is the sum of your highest 35 years of earnings divided by 12 months per year. This gives us the inflation-adjusted Average Indexed Monthly Earnings (AIME) of the individual.

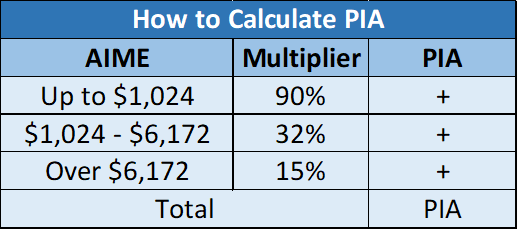

An individual's AIME is used to determine their Primary Insurance Amount (PIA). The PIA is the Social Security benefit a person would receive at their full retirement age. This amount can be adjusted up or down depending on when an individual decides to take their benefit. To calculate the Primary Insurance Amount (PIA), an individual's AIME is divided into three buckets, multiplied by three different fixed percentages, and then added back together to get the total PIA. I find that it is most helpful to understand this step of the formula using a grid to visualize the process. Let's visualize the formula using 2022 number through this grid below:

The first AIME bucket is multiplied by 90%, the second AIME bucket is multiplied by 32% and the third AIME bucket is multiplied by 15%. The three results are all added together to get PIA.

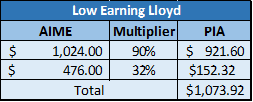

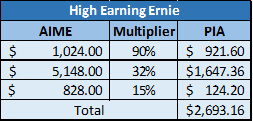

Now let's apply this to some hypothetical examples to help visualize this better. What would the Primary Insurance Amount (PIA) be of Low Earning Lloyd who had an average indexed monthly earnings amount of $1,500 vs High Earning Ernie who had an average monthly earnings amount of $7,000?

Low Earning Lloyd's average indexed monthly earnings amount: $1,500

Lloyd's PIA ends up being very similar to his average monthly earnings amount because the formula is weighted to benefit lower income earners. His PIA ends up replacing 71.59% of his average monthly earnings amount.

Lloyd's PIA ends up being very similar to his average monthly earnings amount because the formula is weighted to benefit lower income earners. His PIA ends up replacing 71.59% of his average monthly earnings amount.

High Earning Ernie's average monthly earnings amount: $7,000

​​​​​​​ High Earning Ernie's PAI is significantly lower than his AIME because more of his income falls in the lower multiplier income buckets. His PIA ends up replacing only 38.47% of his average monthly earnings amount.

High Earning Ernie's PAI is significantly lower than his AIME because more of his income falls in the lower multiplier income buckets. His PIA ends up replacing only 38.47% of his average monthly earnings amount.

The main takeaway from these illustrations is that the Social Security formula for determining your benefit is designed so that your lowest bucket of AIME can make the biggest impact on your PIA.

So how does WEP affect me?

Now that the groundwork for understanding the basics of Social Security has been laid, we can begin to understand how the Windfall Elimination Provision affects your benefit and why it was implemented. The Windfall Elimination Provision affects people who have participated in a Social Security replacement retirement plan AND who still qualify for a Social Security benefit because of their work at a different job that did pay into Social Security.

Prior to the enaction of WEP in 1983 by Congress, an individual's income earning years while participating in a Social Security replacement retirement plan would not be reported in the Social Security AIME/PIA formula. This would result in a lower recorded AIME for the individual and therefore an unfairly higher pre-retirement earnings replacement rate than comparable individuals who had contributed into Social Security their entire career.

Allow me to illustrate the purpose of WEP with this example: Imagine two individuals, Bob and Steve. They work the same number of years and earn the same salaries throughout their entire careers. Bob and Steve both start their career by working for the same employer that contributes the same amount into Social Security for them. The only difference between Bob and Steve is that Steve changed jobs 10 years into his career to an employer that uses a Social Security replacement retirement plan. For 30 more years, the dollars that would have been contributed into Social Security are contributed into his Social Security replacement retirement plan. At the end of 40 years, Bob has 40 years of Social Security contributions and recorded earnings. Steve only has 10 years of Social Security contributions and recorded earnings as well as his Social Security replacement retirement plan.

Before WEP, the Social Security formula would have viewed Steve as a lower income earner and therefore given him a higher income replacement rate than Bob even though their salaries were the same their entire career. WEP was introduced to reduce the unfair advantage that people gained by participating in a Social Security replacement retirement plan.

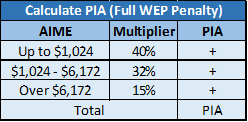

If you participated in a Social Security replacement retirement plan, WEP can reduce your replacement rate multiplier for your first bucket of AIME depending on how many years of substantial earnings are recorded. For people with 20 years or less of substantial earnings, the full penalty will be applied, and your Social Security Benefit will be calculated like this:

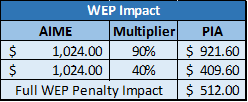

The 90% multiplier will be reduced to 40% if you receive the full WEP penalty. But how does that impact your monthly benefit in dollars? For 2022, the maximum WEP reduction that can be made to your monthly benefit is $512.00.

The 90% multiplier will be reduced to 40% if you receive the full WEP penalty. But how does that impact your monthly benefit in dollars? For 2022, the maximum WEP reduction that can be made to your monthly benefit is $512.00.

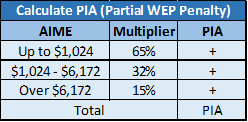

For people who have between 21 and 30 years of substantial earnings, the WEP penalty is reduced by 5% each year of substantial earnings until the multiplier is back to 90% at year 30. This means that if you have over 30 years of substantial earnings, you will not be affected by WEP. If you have 21 years or more of substantial earnings, your WEP penalty will be reduced. For example, an individual with 25 years of substantial earnings will be affected by WEP like this:

For people who have between 21 and 30 years of substantial earnings, the WEP penalty is reduced by 5% each year of substantial earnings until the multiplier is back to 90% at year 30. This means that if you have over 30 years of substantial earnings, you will not be affected by WEP. If you have 21 years or more of substantial earnings, your WEP penalty will be reduced. For example, an individual with 25 years of substantial earnings will be affected by WEP like this:

Instead of receiving the multiplier reduction down to 40%, the penalty reduces their multiplier down to 65%.

Instead of receiving the multiplier reduction down to 40%, the penalty reduces their multiplier down to 65%.

If you would like to have a better understanding of how WEP affects your situation specifically, you can click here to use the official WEP calculator on the Social Security website.

Conclusion

The Windfall Elimination Provision is a complicated rule but there is a logic behind it. It does not eliminate your Social Security Benefit entirely, but it can reduce your benefit depending on how many years of substantial earnings have been recorded. With enough time and planning, there are ways to reduce the impact of this penalty. If you would like to speak with an advisor about your specific situation, feel free to shoot us a message.